1. Is regenerative investable today and what is its level of maturity? What kind of investors would be interested in this opportunity?

Regenerative agriculture is generating strong investor engagement and excitement – both in OECD countries as well as middle-income countries such as Brazil – because compared to conventional practices it is less polluting, supports agricultural system biodiversity, yields healthier food, and improves farming economics (mainly due to reduced input costs, increasing market demand sustainably grown food, and the potential opportunity to earn carbon credits).

2. What are the required and current capital flows into Regenerative Ag? Where are their sources?

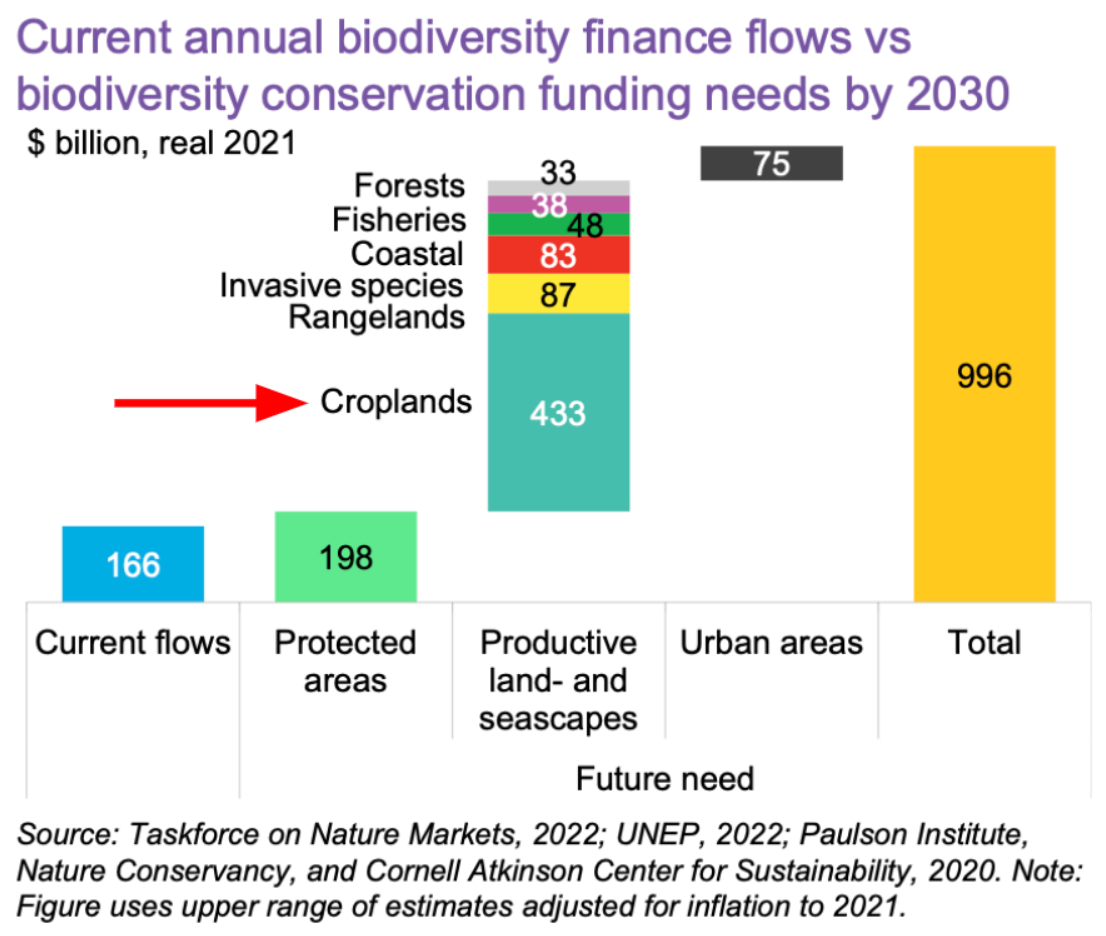

Estimates of the investment required to convert conventional agriculture to regenerative and low-carbon practices vary from $315 - $520bn per year until 2030, nearly the quantity invested in renewable energy infrastructure each year.

Private capital is beginning to flow to regenerative agriculture investment plays around the world. Forty-eight different funds have raised more than $3.9 billion for regenerative agriculture, much of it since the start of 2020. According to research by the family office investor network CREO, institutional investors and agricultural practitioners in North America, Europe, and Australia invested more than $1.3 billion in 2020 alone, four times the $293 million amount they counted in 2019. Agricultural bank lending practices are likely to soon follow this equity investment.

Drawing inspiration from the power of government-led initiatives and major collaborations, a noteworthy example emerged in 2018 when the Government of Andhra Pradesh, in partnership with UNEP and BNP Paribas, initiated a groundbreaking $2.3 billion investment program. This program aimed to transform six million farms into 100% chemical-free regenerative agriculture by the ambitious target year of 2024.

Leading companies in the space include Indigo Agriculture, which recently closed a Series F round raising $535M, CIBO Technologies, which recently partnered with Peoples Company to generate carbon credits for regenerative practices on more than 20,000 acres of managed land, and Pivot Bio which recently raised a total of $616.9M in funding over 7 rounds to help improve crop nitrogen uptake.

Tech giants including Stripe, Netflix, and Amazon are investing across a spectrum of voluntary carbon opportunities, including in agriculture. In a historic deal earlier this year, Australian-owned Wilmot Cattle Co. announced the sale of half a million dollars worth of soil carbon credits to Microsoft. In 2023, Agreena, the most significant soil carbon platform in Europe, reported the results of its second harvest year (HY), marking a tenfold increase in enrolled hectares and a fourfold rise in farmer participation. The agtech company, active in 16 European countries, has become a key player in financing farmers’ transition towards regenerative practices.

A number of real assets investment firms have been formed in the last five years that specialize in investing in farmland for the transition to regenerative practices. For example, Farmland LP, an organization managing approximately $250 million in assets, specializes in the acquisition of conventional farms and currently manages over 16,000 hectares. They are dedicated to integrating regenerative agricultural practices into their operations, aiming to achieve competitive returns while also delivering social and environmental benefits. In the first quarter of 2023, Farmland LP successfully closed Fund II, raising over $140 million, just $10 million short of their $150 million target. Shortly after, in the third quarter of the same year, they launched Fund III with a target size of $250 million.

The Builder’s Fund have just joined forces in a strategic collaboration to promote regenerative agriculture across 2 million acres of farmland in the U.S. and Canada with a combined investment of $120 million. In addition, the giant ag land owners like Nuveen are pivoting their strategies towards faster adoption of regenerative practices.

AXA, Unilever, and Tikehau Capital have revealed their plan to establish a private equity impact fund with a specific focus on investing in initiatives and businesses that promote the shift towards regenerative agriculture. Each of the three partners intends to contribute €100 million to the fund, leveraging their diverse knowledge in industries, risk assessment, and finance to facilitate significant and lasting transformation. Moreover, the fund will be accessible to external investors who are interested in participating in and profiting from this venture, with an overall objective of reaching a fund size of €1 billion.

Food majors which are strategic investors in ag value chains are also seeing the potential of regenerative agriculture as a strategy for lowering their GHG emissions while strengthening supply chains and positioning their brands for the transition. In anticipation of COP27 in 2022, a coalition of major food and agriculture companies, including Bayer, HowGood, Indigo Agriculture, Mars, McCain Foods, McDonald's, Mondelez, Olam, PepsiCo, Sustainable Food Trust, Waitrose & Partners, and Yara International, released a joint report titled "Scaling Regenerative Farming: An Action Plan." The report highlights their collaboration in identifying the challenges farmers encounter when transitioning to regenerative practices and outlines specific actions that agribusinesses can take to provide better support to farmers. This initiative aims to enhance the adoption of regenerative farming methods in the industry. In 2020, General Mills launched a large regenerative pilot and pledged to advance regenerative agriculture on one million acres of farmland by 2030. Nestle recently announced its intention to invest $1.29 billion over the next five years to transition to regenerative across its global supply chain. In September 2021, Cargill announced a payment-for-soil-health initiative aimed at spurring a transition to regenerative agriculture on 10 million acres by paying farmers for carbon.

Another avenue for investment in regenerative agriculture are Real Estate Investment Trusts (REITs). These focus on the acquisition, ownership, and management of specialized properties that fund the transition from conventional to organic and regenerative practices. Investors can participate through REIT shares or a note program, gaining access to a diversified portfolio of organic farmland managed by independent farmers. By employing a diversification strategy across various factors, such as geography, crops, operation size, operator history, and generational history, the initiative seeks to enhance the financial health and performance of the investment. An example of such a REIT is Iroquois Valley Farmland, which has operated since 2016. According to the managers, Iroquois Valley has built a portfolio of more than 110 farmland investments, impacting over 30,000 acres across 19 states.

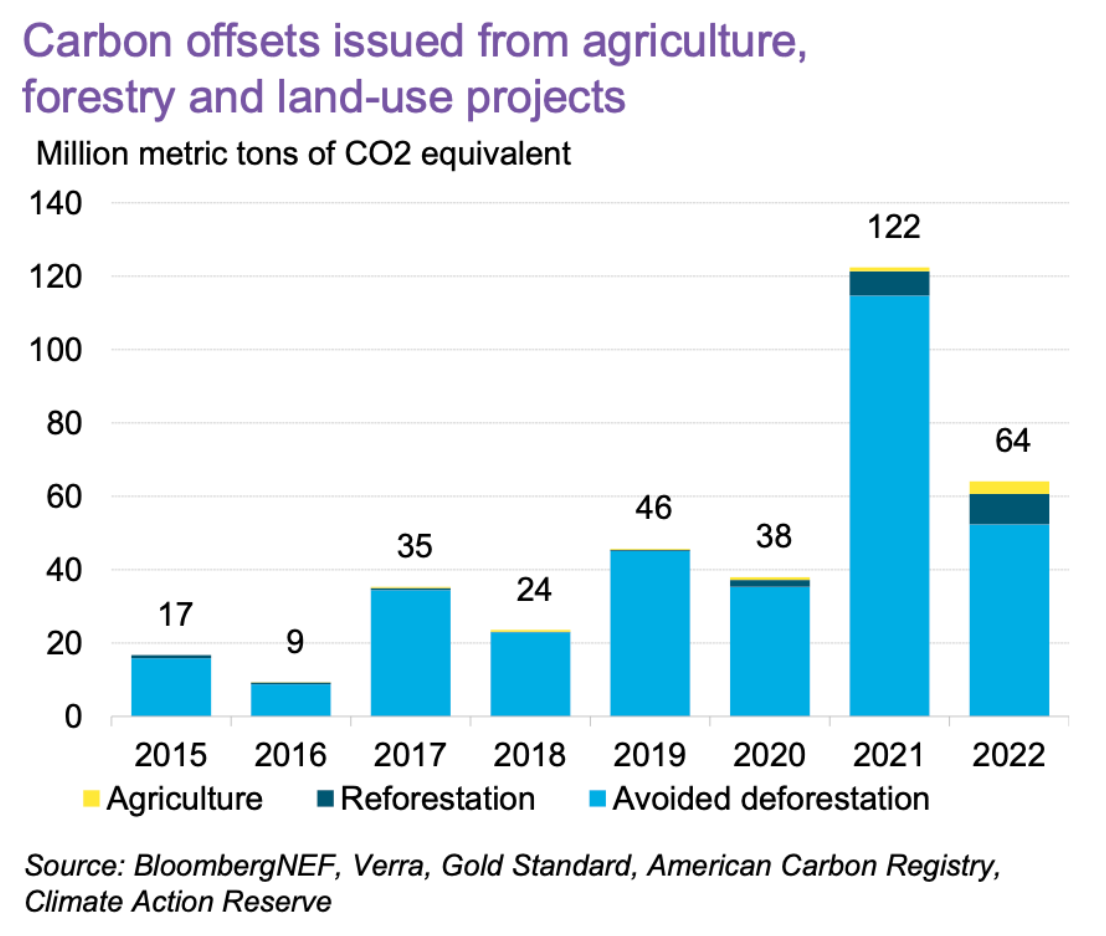

The potential for carbon absorption within regeneratively managed agriculture will likely become a significant factor for corporate investors looking to mitigate supply chain emissions as well as for a subset of financial investors seeking to capitalize on a new potential revenue stream within farmland investment. But as the chart below illustrates, the carbon credit market for agriculture is still nascent. While the technology and methodologies to measure soil carbon have advanced significantly over the past several years, they are still underdeveloped, as are third-party certification standards for soil carbon, and regulatory regimes in the spreading soil carbon compliance markets. Together these factors have slowed development of the market to date; however so long as carbon markets continue to rapidly develop and as soil carbon continues to show yield benefits, the investment rate is likely to ramp.. That said, compared to the market for forest-related carbon credits, agriculture is still only a small part of the mix.

In some countries, policy is creating, or is poised to create, a national market for soil carbon credits, notably in Australia, the UK and most recently in California.

According to S&P Global, the North American agricultural sector has a total yearly potential of generating 326MM tCO2e in carbon credits. Meanwhile, potential demand from corporate buyers varies by region and totals 190 million tCO2e. The market is currently valued at $5.2 billion based on market plus internal company prices for “insetting” or offsetting within ones own value chain.

3. Where are the opportunities? OECD? Middle Income, developing countries?

North America and Europe currently have the fastest growing regenerative agriculture transitions. However Latin America, Asia Pacific and Africa are anticipated to expand regenerative investment activities rapidly due to the amount of degraded lands that could be restored (increasing their value and productivity), carbon market opportunities, and consumer demand in the OECD and elsewhere.

As per a report by the International Union for Conservation of Nature (IUCN) and Vivid Economics, implementing regenerative agriculture to restore degraded lands in Africa has the potential to generate a value of $70 billion for farmers. The report highlights how adopting practices like improved soil management can lead to enhanced human nutrition, livelihoods, and healthier ecosystems. In Brazil, Amaggi, the giant farm corporation, known for trading nearly 19 million metric tons of grains and fibers worldwide, is embarking on a fresh phase of its regenerative agriculture initiative.

4. What's spurring growth, what is holding it back?

A two-year 100-farm study by Cargill and the Soil Health Institute published in 2021 found that more than 75% of regenerative farm participants increased their margin by 20 to 25% on soy and corn, respectively. The WBCSD’s One Planet Business for Biodiversity coalition indicates that transitioning from conventional to regenerative agriculture systems can bring a 15-25% return on investment for farmers.

However, the transition may take three to five years. Learning regenerative practices is non-trivial. It also takes time to rebuild a health soil structure and microbiome to support plant roots, and without traditional fertilization and pest control practices, yields initially decline. During this transition period, farmers may experience a profitability loss of USD $40 per acre. For many farmers – whether in the OECD, middle income, or developing world – this multi-year gap in income is unacceptable.

Without intervention, farmers are burdened with the task of being their own bridge funders, as today transition financing is new for both the dedicated funds and the banks starting to lean into the regenerative transition. The lack of longer tenor financing is a significant barrier for farmers looking to make the transition.

Interestingly these credit market bottlenecks have produced unlocking opportunities that a number of new agriculture SaaS + services companies are exploiting. Examples includeSwiss-Indian Inoterra, U.S.-based OpenTEAM, Indonesian firmsPemPem and Koltiva, and California-based Cultivo – help farmers make the transition by providing longer-term financing and price guarantees , technical assistance, traceability services , and support for developing carbon credits. These types of companies, most often mission as well as profit-driven, are experiencing substantial growth.